Okay, let me start out by saying this:

For 90%+ of people, investing primarily in index funds is the exact right strategy.

Probably more like 95%, to be honest.

The reason? Investing in the general market provides near-zero fees, broad equity exposure, and if history is any indicator, 8-10% per year, adjusted for inflation.

And – there’s minimal opportunity for individuals to get in the way or mess that up.

Just work hard, save, invest, and turn off the TV.

This blog post is for those who actually enjoy investing—or think they have some sort of edge—& there’s one strategy in particular that’s helped me crush the market over the past 17 years or so.

And it completely goes against every talking head on CNBC and every piece of human psychology that feels intuitive.

In fact, biases like loss aversion, disposition effect, and price anchoring have probably cost you more money than you can imagine.

I’m gonna show you why, and how I’ve used that knowledge to my advantage.

Bias Schmias, what am I even talking about?

First, disposition effect is the tendency for investors to sell winning stocks way too soon to lock in gains, or to hold losing stocks way too long to avoid realizing a loss.

This happens because of loss aversion—no matter who we are, we hate losses way more than we enjoy equivalent gains.

Example: Imagine you bought Amazon at $100, and it doubled to $200—you feel a strong urge to sell and “lock in” your gains. That $100 profit per share feels too good to risk losing.

So you sell, congratulating yourself on the 100% return. Genius!

Whereas, if you bought at $100 and Amazon dropped to $80, you’d probably hold on tight—especially since you’ve anchored to $100 (anchor price bias).

Even if Bezos died, Andy Jassy stepped down, and Amazon decided to ditch cloud storage for Cannabis… you’d probably still be clutching those shares!

Can’t. Sell. Until. We. Get. Back. To. $100!

Here’s What I Do Instead

- I decide a stock is worth investing in (whatever the thesis or original hypothesis is).

- I invest in that stock.

- I tune out completely until it’s earnings time. Check back, if the original thesis holds, I invest more (if i have capital).

- If the stock price is going up, it gives me more bullish feelings. Double-down on winners.

- If the stock price is going down, make sure the original thesis holds. If it does, great. If something has changed, sell – regardless of my original purchase price.

- Rinse/repeat.

We’re investing in growth stocks, after-all.

We’re not looking for “hidden gems” or “margins of safety” – no matter how much we all adore Benny Graham and Warren B. (which, I do).

Just find winners – most of the time, they keep winning.

Here are a few examples of times when I purchased a stock – and despite urges to “sell” from the talking donkeys, and despite warnings of “bubbles about to pop” – I saw the positive momentum as signals to keep buying.

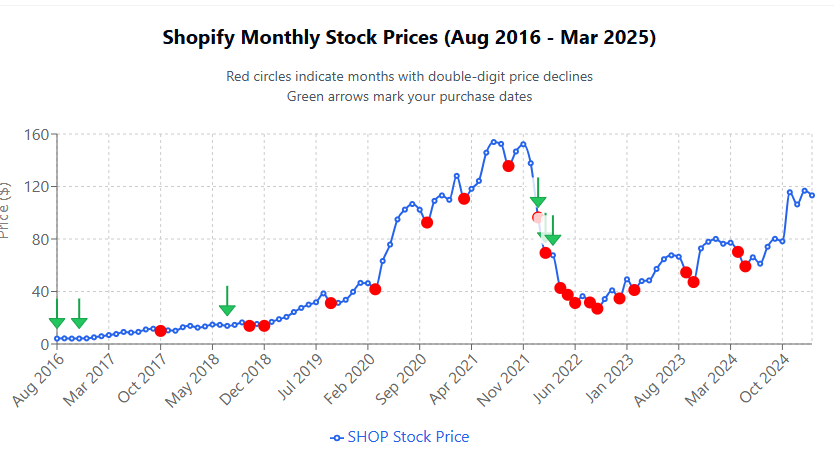

I first bought shares of Shopify (NYSE: SHOP) in August 2016. From then the stock has seen:

- 35 double-digit monthly increases

- 21 double-digit monthly decreases

- 3,225% total return

I haven’t sold any shares, even though the stock has completely sky-rocketed since that time; instead, I doubled-down, tripled-down, etc.

In total, I own seven different lots of Shopify and my average return has been 633%.

The chart below shows the first time I bought – August 2016, and each red dot shows double-digit monthly stock price decreases, and each green arrow shows additional purchases I made.

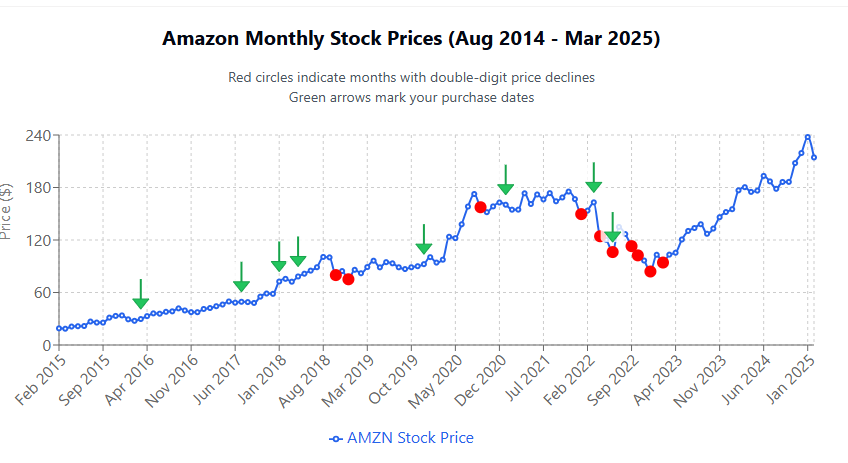

I first bought shares of Amazon (Nasdaq: AMZN) in August 2014. From then the stock has seen:

- 18 double-digit monthly increases

- 10 double-digit monthly decreases

- 1,027% total return

In total, I own nine different lots of Amazon and my average return has been 217%.

The chart below shows the same activity – I held shares, continued to buy on the way up, and ignored any dips unless my thesis had changed.

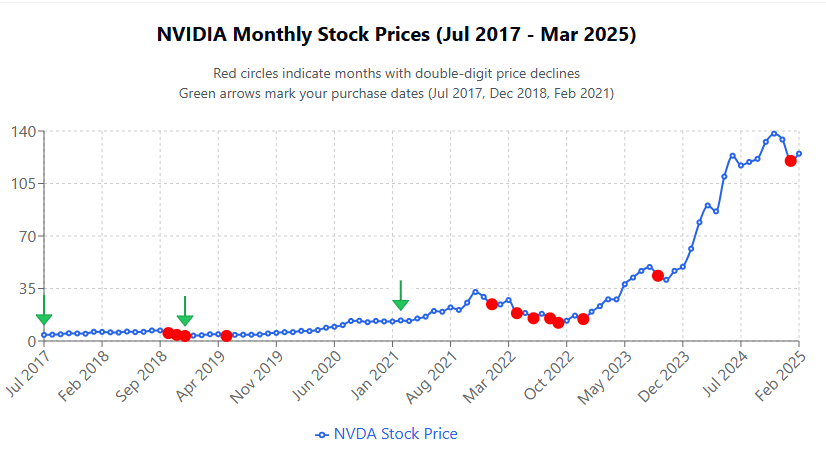

Last but not least, let’s look at Nvidia (Nasdaq: NVDA), when I first bought shares in July 2017. From then the stock has seen:

- 32 double-digit monthly increases

- 12 double-digit monthly decreases

- 3,486% total return

In total, I own three different lots of Nvidia and my average return has been 2,110%.

The chart below shows the same activity – I held shares, continued to buy on the way up, and ignored any dips unless my thesis had changed.

Aren’t I just cherry-picking my winners?

Yes, I am absolutely cherry-picking the winners to illustrate my point.

Among stocks that I have owned that have gone down– and I owned multiple lots – include: Pinterest (NYSE: PINS), Zoom (Nasdaq: ZM), Lemonade (NYSE: LMND), Upstart (Nasdaq: UPST), Docusign (Nasdaq: DOCU), Fiverr (Nasdaq: FVRR)…

Those are just a few. There’s gotta be at least a half-dozen more.

The point isn’t that the strategy I’m describing above is a sure-fire way to pick winners. It’s also not a sure-fire way to avoid picking losers, or to make money all the time.

The point is that when you have a winner—and a stock price is going up—you should fight your natural instinct to cut bait and sell, and instead, consider buying more.

Remember, you can only lose what you’ve invested (unless you’re effing around with margin, which you never should), but your potential gains are literally infinite.

Credit where credit due

The reason I had any aptitude for stock-picking, and more importantly, the psychology to use this approach, is because I worked at The Motley Fool for 12 years.

The Motley Fool—co-founded by brothers David and Tom Gardner—taught me tons about investing and business. Tom was my boss for many years, I worked alongside both brothers for a decade-plus, and I was surrounded by investing junkies all helping each other learn and make money.

As David Gardner says, “I try to find excellence, buy excellence, and add to excellence over time. I sell mediocrity. That’s how I invest.”

Summing it up

When it comes to investing, most everyone should be investing in broad, low-cost index funds.

But if you’re going to buy individual stocks, try to follow these general principles:

- Avoid throwing good money after bad

- Avoid selling your winners (there doesn’t have to be a “sell” in “buy low, sell high!”)

- Avoid listening to CNBC, reading Yahoo or Google Finance, or anyone else that has a major stake in just monetizing your attention or getting clicks

- Do add to your winners

- Do hold your stocks for a long time

- Do sell a stock if it’s gone down and your thesis has changed

By far, the greatest investing gift I ever received was behavior and temperament.

It’s the greatest investing edge there is.